Acquisition project | Blissclub

What is Blissclub? 🤔

Criteria | Description |

What is it? | Blissclub is a women-centric athleisure brand |

Founded | 2020 |

Based In | Bengaluru |

Founder | Minu Margeret |

Form Factor |

E-commerce channels such as Amazon, Myntra, Nykaa, Ajio, Flipkart, Tata Cliq & Quick Commerce like Swiggy Instamart. |

Region(s) | PAN India |

Value Proposition |

|

Why pick Blissclub? 🤷🏾♂️

I got a chance to work at Blissclub in the initial days where I helped the brand to set-up the business over the marketplace and managed it along with P&L operations it, so I have seen the brand from the Early stage to reaching PMF.

- Scale of operation

Customer Count - 3 lakh + Users, Across Online, Offline & E-commerce channel.

Almost 4.2 + Rating over 35,000 + Reviews - Funding to date

Raised $20.3M Seed round from Eight Roads Ventures, Elevation Capital & Angel investors in 2021 till date.

Over just 3 years they have expanded the business into 5 more categories and 100 + new products. They have grown the business within a span of two years from 0.4cr in 2020-2021 to 72.1cr in 2022-2023

Competition Landscape | Players | Reason of buying | What can shift them? | Target Income Level |

Big Players | Nike, Adidas, Puma, Lululemon | Loyalty, Durability, Strong global reputation | Innovation in product offerings Better pricing Personalization Enhanced customer experience | High-income, Affluent consumers and fitness enthusiasts willing to spend more for quality |

New Age Brand | HRX, Cultfit, Cava, Silvertraq | Fashionable Affordable Community-oriented Brand alignment with lifestyle Celebrity endorsements Trend-driven designs Comfortable yet stylish | Enhanced quality and performance Stronger community engagement Exclusive collections Better price-to-quality ratio More diverse product range | Middle to upper-middle-income, Millennials and Gen Z who are budget-conscious yet brand-aware |

Elevator Pitch

Do you ever struggle to find activewear that’s both stylish and functional, leaving you uncomfortable during your workout?

Do you wish your leggings could keep up with your high-intensity training, yoga sessions, or morning runs?

If your answer is YES, then Blissclub is here to transform your fitness journey. Loved by thousands of active women across India, Blissclub is your go-to destination for premium women’s activewear.

With Blissclub, you get more than just leggings. You get high-performance gear designed for comfort, durability, and style. Simply visit our website, explore our wide range of products tailored to different workouts, and get them delivered to your doorstep.

Say goodbye to the compromise between fashion and functionality—Blissclub leggings move with you, not against you.

Issue Addressing

Over 52.6% of Indian women more than 30 crore are physically inactive, many held back by insecurities about their body shape. This stops now, Our mission is to get every woman in India moving daily, shatter the barriers of self-doubt, and ignite a movement of confidence. At Blissclub, we believe every woman's body is powerful and unique, and it's time she embraces it fully. We're here to empower her to own her strength, redefine her limits, and fall in love with herself like never before.

We're crafting the most skin-comforting, stylish, and innovative products for Indian bodies, available in all sizes. Our designs are not just functional but also tailored to move with you, ensuring comfort and style in every step.

Squat at the gym, kick back at work, sit cross-legged on a plane, or do a cartwheel in the park—wherever life takes you, and however you choose to move, we’ve got you covered. #KeepMoving

Understand your Product

Blissclub is on a mission to redefine activewear for women, focusing on comfort, functionality, and style. They are designing products that women can wear all day—whether they're working out, running doing yoga, or just relaxing.

The core value proposition lies in creating innovative, skin-comforting products that empower women to move freely and confidently in any activity. Blissclub isn’t just about activewear; it’s about enhancing the everyday lives of women by providing them with the comfort and flexibility they deserve.

Reviews (80 - 85% of business comes from bottom wear itself)

Strengths

- Ultimate Comfort, Fit, and Stretch

- Inclusive Sizing, No Camel Toe, and Handy Pockets for Everyday Convenience

- Style and Design

- Versatile Enough for Both Workouts and Office Wear

The core

Weakness

- Tight Waistband Fit

- High Pricing

- Return and Exchange Difficulties

- Subpar Customer Support

- Durability Issues

- Back Pocket issues along with product length

Understanding Core Value Proposition

Blissclub's products are crafted specifically for Indian women who need comfortable and versatile clothing for all activities, from yoga and gym sessions to casual outings. The brand is on a mission to empower every woman to stay active in her daily life. Unlike other brands that cater primarily to Western body types, Blissclub focuses on creating size-inclusive products tailored to Indian bodies which are body hugging, Their activewear offers the perfect combination of Fabric, Fit, and functionality, addressing common issues like having less pockets, and not enough stretch, don't last too long, too tight to wear them for hours and workout in it.

Customer reviews

- Why did you choose us over our competition?

Our customers choose us because of the superior functionality and size inclusivity we offer. The comfort and stretch of our products are unparalleled, and they retain their quality and appearance even after extended use, outlasting other brands. - Why do you keep doing business with us?

Customers continue to choose us because our products provide exceptional comfort and effectively meet their needs. The unique, lightweight material ensures they don't feel heavy, allowing for all-day wear in any setting. - What words would you use to describe our company?

If I had to describe blissclub in one word, it would be Bodyhugging. - If you were referring a friend to our business, what would you tell them about us?

I’d tell them that blissclub offers the most stylish and comfortable leggings, equipped with extra pockets that meet all your needs, making them perfect for any activity or occasion.

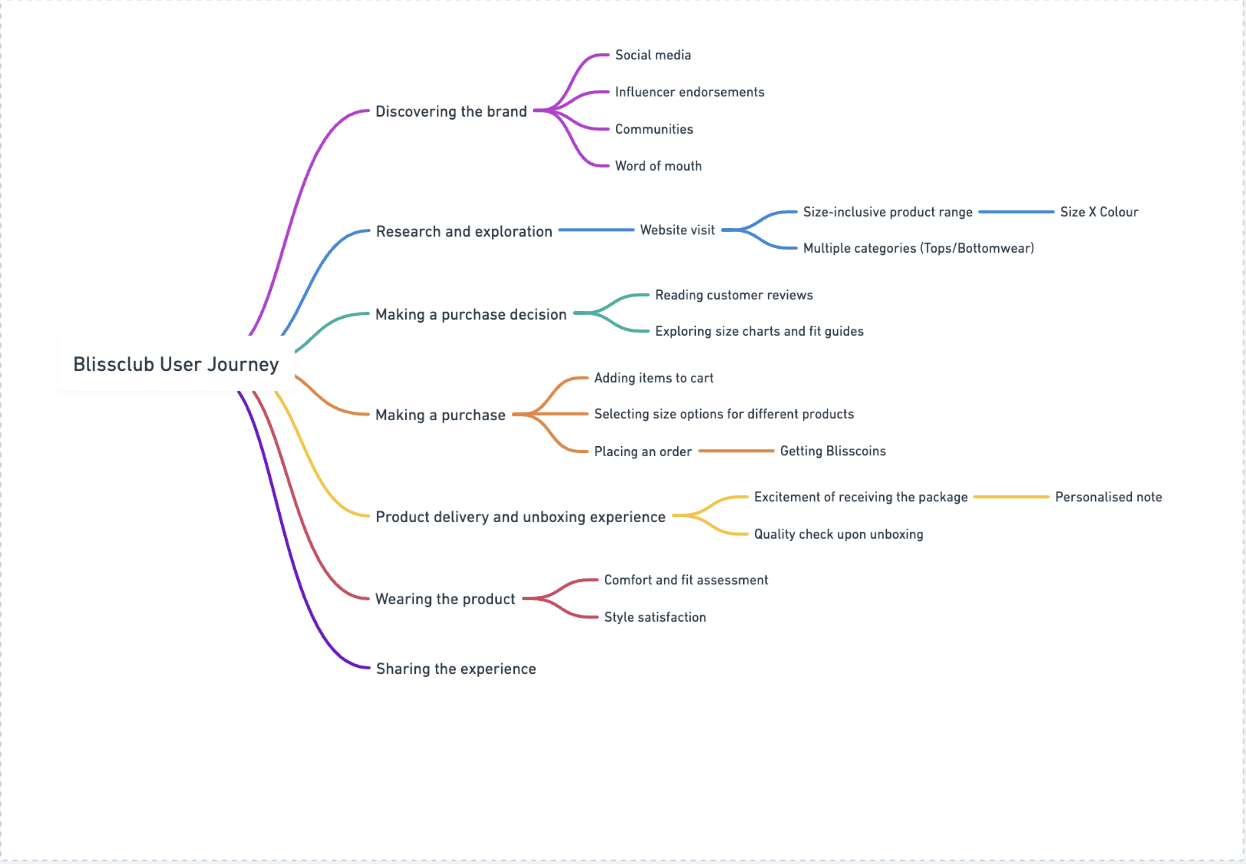

User Journey

The Core Value Proposition are

- Size Inclusivity: We design our products to cater to all sizes, ensuring a perfect fit for the diverse body shapes of Indian women.

- Comfort & Fit: Our fabric is incredibly light and breathable, providing unmatched comfort. It offers just the right amount of stretch, making it ideal for all types of activities, so you can move freely and feel at ease all day long.

- Functionality: Our activewear is equipped with ample pockets, designed to hold everything you need—from your phone to your earbuds and keys—keeping you prepared for anything.

- Versatility: Whether you're at home, out for a run, practising yoga, hitting the gym, or even attending a party, our products are versatile enough to keep you looking stylish and feeling comfortable.

- Quality and Durability: We use premium fabric that ensures longevity. Our activewear provides a balanced stretch, so it never feels too tight or too loose, maintaining its shape and comfort over time.

Understanding the Users

Question | Age Group 20-30 | Age Group 30-45 |

How did they get to know about the brand? | Over 80% discovered the brand through Instagram paid ads and word of mouth. | Similar discovery patterns, but also rely on word of mouth and reviews. |

What convinced them to buy the product? | Influenced by Instagram ads, word of mouth, and influencer activities. | Tend to research the brand first, often checking reviews on YouTube. |

What was the biggest pain point after buying it? | Size chart inaccuracies, poor customer support, and long delivery times. | Same concerns, with an emphasis on the slow exchange process (14+ days). |

Where do users like to buy the product from? | Prefer buying from the website, e-commerce marketplaces (Myntra, Amazon, etc.), and offline stores. | Prefer offline stores to try before buying; it takes longer to decide. |

What do they like and don't like about the brand? | Appreciate extra pockets and fabric comfort, willing to pay for these features. | Value stretch and feel of the product for all-day wear. |

How often do they buy the product? | Purchase more frequently, attracted to multiple colours and unique styles. | Buy less often, and prioritize functionality over new colors and SKUs. |

Purchase frequency? | Typically once a quarter. | Usually once a year (more often if used for gym or yoga). |

What influenced them to buy leggings over other brands? | Drawn by brand story, influencer marketing, functionality, fashion, and reviews. | Influenced by word of mouth, reviews, influencers, and community. |

Understanding your ICP

B2C Table

Criteria | User 1 | User 2 |

|---|---|---|

Name | Sonali | Jayalakshmi |

Age | 20-30 | 30-45 |

Demographics | Tier 1 cities in India. Eg: Mumbai, Bengaluru, New Delhi, Pune, Hyderabad, Chennai, Kolkata, and Ahmedabad. | Tier 1 & Tier 2 cities in India. Eg: Luckhnow, Jaipur, Bhopal, Surat, Nagpur, Noida, Gurugram, Nashik |

Need | Fashionable, Comfort, Functionality, New Designs | Functional, Comfortable, Durable |

Pain Point | Finding stylish, functional, and comfortable leggings which can be used for all kinds of activities | Finding durable leggings that fit well and are comfortable for long wear |

Brand Solution | Blissclub Flare pants & Ultimate legging, with stylish tops and Sports bras which are both functional and durable | Blissclub Trousers, Leggings & Tops with comfort, durability, and thoughtful design for Indian body types |

Behaviour | Impulse buyers, influenced by social media and word of mouth | Research-oriented, prefers to check reviews and recommendations before purchase |

Income Levels | 7-15 Lakh | Upward of 15 lakh -45 lakh |

Marital Status | Mostly single or recently married | Mostly married, possibly with children |

Perceived Value of Brand | High value due to comfort, style, and functionality | Practical and reliable with good long-term value & price conscious. |

Where do they spend time? | Instagram, YouTube, Online shopping websites & Marketplace | YouTube for reviews, Facebook, Offline stores for trying products |

Marketing Pitch | Fashion-forward comfort that moves with you. Experience the perfect blend of style, functionality, and stretch with Blissclub leggings. | Reliable comfort for every move. Blissclub leggings are built to last, with the perfect fit and functionality for your busy lifestyle. |

Pain Points? | Tight waist sizes, high price, Camel toe, lint issues with returns and customer support | High price, size chart inaccuracies, slow delivery times, less responsive customer support |

Current Solutions | Regular leggings from other brands, lack pockets, stretch, and comfort for long hours | Basic, non-branded leggings that lack Blissclub's features, or international brands with inconsistent sizing |

Frequency of use case | Daily or weekly, depending on activity levels | Weekly or bi-weekly, depending on activities like gym or yoga |

Average Spend on the Product | ₹2,000 - ₹3,500 | ₹3,000 - ₹5,000 |

Value Accessibility to Product | High, available online and in multiple offline stores | Moderate, prefer offline stores for purchase but open to online if convinced |

Value Experience of the product | Very satisfied with the comfort and functionality, but the price and customer service could be better after a few washes some products started showing lint. | Satisfied with durability and comfort, but hesitant due to sizing and service issues along with negative reviews |

Decision Time | Quick, usually within 2-3 Days after exposure to social media ads or influencer recommendations | Takes longer, typically a week or more after thorough research and possibly visiting a store |

How often do they buy? | Every month | When it is needed |

ICP prioritization table

Criteria | ICP 1 | ICP 2 |

|---|---|---|

Adoption Curve | High | Low |

Appetite to Pay | Low | High |

Frequency of Use Case | High | Medium |

Distribution Potential | High | High |

TAM | High | High |

Understand Market

Blissclub App Onboarding Journey

The biggest issue I encountered was the inability to cancel my order after placing it—there was no option available. Although the FAQ section mentions that cancellations are not allowed, this was not clearly communicated before I made the purchase. Additionally, the referral program was only highlighted after the order was placed.

Competitor Strategy

Factors | Competitor 1 - Nike | Competitor 2 - Cultsport | Competitor 3 - Puma | Competitor 4 - Cava |

What is the core problem being solved by them? | High-performance athletic wear with a focus on sustainability and innovation. | Affordable, functional fitness wear designed for the Indian market. | Stylish, performance-oriented sportswear accessible to a wide audience. | Comfortable, fashionable activewear targeting women who prefer inclusivity in sizing. |

What are the products/features/services being offered? | Squat-proof, Sustainable material, High Waist | Squat-proof, moisture-wicking, Pockets, Stretch, Waistband, Soft fabric | High intense activity, stylish designs, versatile for various sports, moisture-wicking | Inclusive sizing, fashionable, squat-proof, breathable fabrics, high waist, soft and stretchy material |

Who are the users? | Athletes, Fitness Enthusiasts, Casual Wearers, Brand Loyalists | Fitness enthusiasts, Gym-goers, Yoga practitioners | Athletes, Fashion-conscious individuals, sportswear users, | Women seeking comfortable, stylish, and inclusive activewear |

GTM Strategy | Global presence with a strong emphasis on innovation and digital marketing | Digital-first approach with a focus on partnerships with fitness apps, gyms and influencers | Strong brand presence in both retail and online, leveraging endorsements from athletes | Niche market strategy focusing on inclusivity and comfort, digital marketing |

What channels do they use? | Own retail stores, Online (Nike.com), Partnered retailers, Social Media, Apps (Nike Run Club), e-commerce platform | Online platforms (Cult. fit, Myntra, Amazon), Social Media, Fitness apps, Gyms | Retail stores, Online (Puma.com), Partnered retailers, Social Media, E-commerce | Online store, Social media, Collaborations with fitness influencers |

What pricing model do they operate on? | Premium pricing with occasional discounts | Affordable pricing with value-for-money positioning, with as high as 20% discount | Mid-range to premium pricing, accessible to a broader market | Mid-range pricing with a focus on quality and inclusivity |

How have they raised funding? | Publicly traded company, Self-funded through revenue | Backed by Curefit, funded through the parent company's resources | Publicly traded, Self-funded through global revenue | Venture-funded, part of a larger brand portfolio |

Brand Positioning | High-performance, innovation-driven brand with a focus on athletes and fitness enthusiasts | Affordable, functional fitness gear tailored for Indian consumers | Stylish, versatile sportswear for everyone, blending fashion with performance | Inclusive, comfortable, and fashionable activewear for women of all sizes |

UX Evaluation | Seamless online and in-store experience, with a focus on personalized customer journeys | User-friendly digital platforms with integration into fitness ecosystems | Consistent experience across channels, with emphasis on ease of purchase and brand engagement | Focused on ease of navigation, inclusive sizing guides, and seamless shopping experience |

What is your product’s Right to Win? | Brand legacy, innovation in material and design, global reach | Leveraging a localized approach and affordability, Cultsport enhances its strong digital presence. With their own gyms, they can easily convert existing users into loyal customers. | Versatility, stylish designs, strong brand recall | Inclusivity, comfort, and focus on body positivity |

What can you learn from them? | Innovation in product design, strong global brand positioning | Effectiveness of localized digital strategies and partnerships | Importance of blending fashion with performance, leveraging athlete endorsements | The power of inclusivity and niche marketing in creating brand loyalty |

Competitor Acquisition/Retention/Onboarding/Monetization Model

Players like Nika, Cultsport and HRK are highly focusing on partnership as a channel for their customer acquisition.

Opportunity for Growth at Category Level

Category | Current Focus | Opportunities for Growth |

Tops | Standard designs and pricing | Improve design and pricing; add moisture-wicking and quick-dry fabrics. |

Leggings | Basic offerings | Develop leggings with moisture-absorbing technology; expand design variety for gym use. |

Sports Bras | Minimal focus | Design with better support and comfort; include adjustable straps, removable padding, and activity-specific designs. |

Track Pants | Limited focus on performance and design | Enhance features like moisture-wicking fabrics, adjustable waistbands, and versatile designs. |

Formal Wear | Minimal focus | Explore athleisure-inspired formal wear blending comfort with style. |

Yoga Pants | Basic offerings | Expand the range with high elasticity, breathable materials, and stylish designs. |

Body Suits | Basic offerings | Introduce more options with a focus on fit, comfort, and style. |

Accessories | Limited range | Add headbands, gloves, Caps, and other functional accessories. |

Outerwear | Limited options | Introduce jackets and hoodies suitable for both workouts and casual wear. |

Swimwear | Minimal focus | Explore active swimwear and cover-ups. |

Activewear Sets | Limited range | Offer coordinated sets for ease of styling. |

Innerwear | Not a current focus | Introduce comfortable and supportive innerwear options that complement the activewear range. |

Dancing Gear | Not a current focus | Develop products like flexible dancewear, performance tights |

Running Gear | Not a current focus | Introduce high-performance running shoes, and breathable and lightweight fabrics for tops and bottoms for convenience. |

Macro Research

Tshirt is the most popular Athelisure category, so by just focusing over it will help the brand to improve the topline business for them

Globally, tops account for 40-45% of athleisure sales, while at Blissclub, bottomwear contributes 80-85% of revenue.

New Trends

The sustainable clothing market is expanding rapidly across the Asia-Pacific region, with many brands increasingly prioritizing eco-friendly and sustainable products. For example, Satva is known for its focus on environmentally friendly and sustainable offerings.

Technology to explore

Direct & Indirect Competition

Competitors

Direct Competitors:

- Cultsport: Known for its activewear designed for both high-performance activities and casual wear. Cultsport offers a range of products that overlap with Blissclub’s athleisure line.

- Cava: Focuses on offering a broad range of styles and categories in athleisure, operating in both men’s and women’s segments.

- HRX: Founded by Hrithik Roshan, HRX offers a broad range of activewear and fitness apparel, catering to a similar target audience as Blissclub.

Indirect Competitors:

- Decathlon: Provides a wide range of affordable and functional sportswear and activewear, appealing to budget-conscious consumers and covering many similar categories.

- Zivame: Known for a broad selection of women’s intimate wear and activewear, directly competing with Blissclub’s offerings in the women’s athleisure segment but not in the same price point.

- Clovia: Offers a range of women’s athleisure, including activewear and sportswear, competing with Blissclub’s product line in terms of both product types and target demographics.

Differentiation

What Sets Blissclub Apart:

- Size Inclusivity: Blissclub’s emphasis on being a brand for all sizes differentiates it from competitors, especially in a market that increasingly seeks inclusive options.

- Mission-Driven Brand: The focus on encouraging movement and body positivity is a unique selling point that resonates with a specific segment of the market.

- Community Engagement: Traditional offline activations and community-building efforts provide a unique touch compared to digital-first competitors.

- Quality Offering - Blissclub provide the best quality product which are durable and last longer than others.

Competitors' Unique Selling Points:

- Cultsport: Offers a diverse range of high-performance and stylish activewear, catering to both fitness enthusiasts and casual wearers.

- Cava: Known for its extensive styles and categories, covering both men’s and women’s athleisure, although not focused on sustainability.

- HRX: Benefits from celebrity endorsement and a broad product range that includes both high-performance and casual activewear.

- Decathlon: Competitive pricing and a wide product range that appeals to value-seeking consumers.

- Zivame: Extensive range of women’s intimate and activewear, often with strong promotions. & affordable price.

- Clovia: Competitive pricing and a wide selection of women’s athleisure and sportswear & low price point.

Competitors to Watch

Current Threats:

- Cultsport: Competitive due to its broad activewear range and focus on both performance and style.

- Cava: A significant competitor due to its extensive styles and categories, appealing to a wide range of customers.

- HRX: The celebrity endorsement and extensive product line make HRX a strong competitor in the local market.

- Decathlon: Its broad range better pricing and expansion capacity.

- Zivame: Strong presence in women’s intimate and activewear categories.

- Clovia: Competitive offerings in women’s athleisure, with frequent promotions and diverse product lines.

Potential Future Competitors:

- Emerging Local Brands: New entrants focusing on niche markets or innovative products could disrupt the market.

- International Brands Expanding into India: Global brands entering the market with competitive offerings may pose a future threat. (Lululemon entering in Indian market)

Competitor Features or Propositions

Features or Propositions Competitors Have that Blissclub Doesn’t:

- Advanced Fabric Technology: Competitors like Cultsport and HRX may offer advanced fabric features that Blissclub does not currently emphasize.

- Broad Range of Styles and Categories: Cava’s diverse range of athleisure styles for both men and women provides a broader selection compared to Blissclub.

- Celebrity Endorsements: HRX’s association with Hrithik Roshan enhances its brand visibility and appeal.

- Competitive Pricing: Decathlon’s affordable pricing and Zivame’s frequent promotions are strong selling points.

- Extensive Product Range: Clovia’s wide selection of women’s athleisure and sportswear.

Reasons Behind These Gaps:

- Strategic Choice: Blissclub may prioritize size inclusivity and community engagement over fabric technology or extensive style ranges.

- Resource Limitation: Developing advanced fabrics, expanding product lines, or engaging in high-profile endorsements requires significant investment, which might not align with Blissclub’s current strategy.

TAM/SAM/SOM

TAM (Total Addressable Market)

Step 1: Define the Total Population of Women in India

Total Population of India: 1,400,000,000

Percentage of Women: 48.5%

Total Women in India: 1,400,000,000 × 48.5% = 679,000,000 women (679 Million)

Step 2: Segment Women by Age Group

Percentage of Women Aged 20-50: 30-35% (We have considered 30%)

Total Women Aged 20-50: 679,000,000 × 30% = 203,700,000 women

Step 3: Segment Women by Tier 1 and Tier 2 Cities

Percentage of Women in Tier 1 and Tier 2 Cities: 35%

Women Aged 20-50 in Tier 1 and Tier 2 Cities: 203,700,000 × 35% = 71,295,000 women

Women Aged 20-50 in Tier 3 and Rural Areas: 203,700,000 × 65% = 132,405,000 women

Step 4: Identify the Target Segments for Athleisure/Activewear

1 - Women Who Workout in Tier 1 and Tier 2: 71,295,000 × 25% = 17,823,750 women

Potential Customers from Workout Segment: 17,823,750 × 65% = 11,605,438 women

Women Who Don’t Workout in Tier 1 and Tier 2 Cities: 71,295,000 × 75% = 53,471,250 women

Potential Customers from Non-Workout Segment: 53,471,250 × 10% = 5,347,125 women

Total Potential Customers in Tier 1 and Tier 2 (Aged 20-50): 11,605,438 + 5,347,125 = 16,952,563 women

2 - Women Who Workout in Tier 3 and Rural Areas: 132,405,000 × 5% = 6,620,250 women

Potential Customers from Workout Segment: 6,620,250 × 40% = 2,648,100 women

Women Who Don’t Workout in Tier 3 and Rural Areas: 132,405,000 × 95% = 125,784,750 women

Potential Customers from Non-Workout Segment: 125,784,750 × 5% = 6,289,238 women

Total Potential Customers in Tier 3 and Rural Areas (Aged 20-50): 2,648,100 + 6,289,238 = 8,937,338 women

Step 5: Adjust for Affordability and Target Market

Segment 1: Tier 1 and Tier 2 Cities

Affordable Customers in Tier 1 and Tier 2: 16,952,563 × 50% = 8,476,282 women

Segment 2: Tier 3 and Rural Areas

Affordable Customers in Tier 3 and Rural Areas: 8,937,338 × 20% = 1,787,468 women

Total Affordable Customers (All Tiers, Aged 20-50): 8,476,282 + 1,787,468 = 10,263,750 women

TAM (Total Addressable Market):

Total Users: 10,263,750 women

ARPU (Average Revenue per user) / - 2400 INR

TAM - Total Users X ARPU

TAM - 10,263,750 × 2400 INR = 24,632,999,999 INR (24.6 Billion)

SAM (Serviceable Addressable Market):

SAM = TAM x Target Market Segment

SAM = 24,632,999,999 INR × 80% = 19,706,400,000 INR (19.70 Billion)

SOM (Serviceable Obtainable Market):

SOM = SAM x Market Penetration/Share

Penetration assumption is taken at 10%

SOM = 19,706,400,000 INR × 10% = 1,970,640,000 INR (1.97 Billion)

Summary

Designing Acquisition Channel

Channel Name | Cost | Flexibility | Effort | Speed | Scale | Budget |

Organic | Low | High | High | Low | High | Low |

Paid Ads | High | Mid | Mid | High | High | High |

Referral Program | Low | High | Mid | Mid | High | Low |

Product Integration | Mid | Mid | High | Low | Mid | Mid |

Content Loops | High | High | High | Low | Medium | Medium |

At Blissclub's PMF stage, I'll focus on SEO, Referral, and Product Integration as primary channels, with Paid Ads and Content Loops as secondary options.

Detailing your Acquisition Channel

Channel Name | Audience Selection | Rationale | Cost | Flexibility | Effort | Speed | Scale | Budget |

Google Search | General audience interested in activewear & looking for athleisure brands | High reach, strong intent-based searches | Medium | High | Medium | Fast | High | Medium |

Google Ads | Targeted based on demographics and behaviour | High visibility, immediate results, highly targeted | High | Medium | High | Fast | High | High |

Google YouTube | Activewear enthusiasts, fitness channels | Visual engagement, high user interaction, good for brand awareness | Medium | High | Medium | Medium | High | Medium |

Women 18-45 interested in fitness fashion | Large user base, strong targeting options, good for engagement and brand loyalty | Medium | High | Medium | Fast | Medium | Medium | |

Young women, fashion-forward fitness lovers | Visual platform, strong for influencer marketing and direct engagement | Medium | High | Medium | Fast | High | Medium | |

Programmatic | The broad audience, customizable targeting | Automated ad buying, extensive reach, efficient targeting | High | Medium | High | Fast | High | High |

Amazon Ads | Shoppers looking for activewear | High purchase intent, strong e-commerce platform | Medium | Medium | Medium | Fast | Medium | Medium |

Myntra | Women looking for fashionable activewear & Daily wear | High relevance for fashion and activewear shoppers, targeted audience | Medium | Medium | Medium | Fast | High | Medium |

Nykaa Fashion | Women interested in fashion | Strong female demographic, cross-promotion opportunities with beauty products | Medium | Medium | Medium | Fast | Medium | Medium |

Ajio | Shoppers on Ajio, Category Based | Known for trendy fashion, good platform for reaching fashion-conscious activewear customers | Medium | Medium | Medium | Fast | Medium | Medium |

Amazon Display | Shoppers on Amazon, interest-based targeting | High purchase intent, broad reach, good for retargeting customers already familiar with the brand | Medium | Medium | Medium | Fast | High | Medium |

I will prioritise these channels for D2C

- Google Search

E-commerce -

- Myntra

- Amazon

- Nykaa fashion

- Ajio

Blissclub and Cava launched in the same year yet the Organic search of Cava is 2xm Social search is almost 30% higher. Blissclub needs to work heavily over SEO optimization

Organic Channel

The core product is legging

Core market is Tier 1 and Tier 2 Cities

The organic ranking across all platforms for core generic keywords is very low. While ad visibility remains on Amazon and Myntra, the organic performance on Amazon is still lacking.

Purpose | Keyword (including all variations & related keywords) | Search volume (avg monthly) | Difficulty to rank on SEO | Avg cost per click | Projected Click-through rate (CTR) | Cost per website land | Rationale |

| Use Case | Legging for gym | 8,100 | 65 | ₹10-₹15 | 5-7% | ₹142 | High demand for gym leggings |

Yoga leggings | 4,400 | 55 | ₹8-₹12 | 6% | ₹120 | Growing interest in yoga | |

| General | Leggings for women | 27,100 | 70 | ₹12-₹18 | 4-5% | ₹170 | Broad category search term |

Activewear legging | 9,900 | 60 | ₹9-₹14 | 5% | ₹150 | Consistent market presence | |

| Competitor | Cultsport legging | 2,400 | 50 | ₹7-₹10 | 7% | ₹100 | Direct competition |

Cava leggings | 1,300 | 48 | ₹6-₹8 | 8% | ₹90 | Competitor with lower brand awareness | |

| Your Brand Name | Blissclub leggings | 5,400 | 40 | ₹5-₹7 | 9% | ₹80 | Branded search with strong conversion |

Blissclub leggings for women | 2,000 | 38 | ₹4-₹6 | 10% | ₹75 | High brand recognition |

Content Loop

Platform Selection for Blissclub Content Loop

| Platform | Engagement Rate | Content Type Suitability | Reach |

|---|---|---|---|

High | Visual content, short videos | High | |

| YouTube | Medium | Long-form videos, tutorials | Medium to High |

Medium | Visual content, style tips | Medium | |

| Blogs and Websites | Medium | In-depth articles, testimonials | Medium |

| Email Marketing | High | Curated content, promotions | Direct reach |

| Fitness Apps (Partnerships) | High | Integrated product content | Niche, targeted |

Their page mostly features high-intensity workout content, with little to no focus on how the products can be used for Zumba, yoga, dance, or running.

Paid Ads

Before we enter the word of Paid Ads to figure out CAC - let’s take a quick look at the LTV calculations

Assumptions / Known Facts

- 60% average Gross Margin

- The frequency of users is 2

LTV for blissclub user = { { User AOV * Frequency of Order (per month* Average User retention)

= (2400 * 1 * 2)

= ₹4800

Channel | CPC | CVR | CAC |

12.6 | 0.70% | 1800 | |

9 | 0.50% | 1800 |

The CAC to LTV Ratio stands at 1:2.7

Since I can (in theory) achieve an LTV:: CAC which is 1: 3 (with a margin of safety), I believe we can pursue a paid ads strategy

As we planned out in the Acquisition channel model we will go ahead with Instagram & Google ads along with E-commerce we will leverage the traffic which the platform already brings

Creative and audience selection

Campaign Structure

Campaign Structure:

- Campaign Name: “Blissclub – Move with Confidence”

- Objective:

- Primary Objective: Brand Awareness and Reach

- Secondary Objective: Conversions (Drive Sales via Website and Social Media)

- Platforms:

- Primary: Instagram, Google Search

- Secondary: Facebook, Google Display Network, YouTube

- Targeting:

- Custom Audiences: Users who have interacted with Blissclub's social media, website visitors, and past purchasers.

- Lookalike Audiences: Based on existing customers and website visitors.

- Interest-Based Targeting: Targeting based on fitness, body positivity, and sustainable fashion.

- Ad Groups:

- Ad Group 1: “Everyday Fitness” - Targeting regular gym-goers and yoga enthusiasts who have an interest in Zumba, Dance, Running, and Callisthenics.

- Ad Group 2: “Size Inclusivity” - Targeting plus-size women with a focus on size-inclusive activewear.

- Ad Group 3: “Comfort & Style” - Targeting professionals and busy mothers who value comfort in their activewear.

- Ad Copy Examples:

- Headline: “Embrace Your Shape with Blissclub”

- Body: “No matter your size, Blissclub has the perfect fit for you. Shop our range of size-inclusive activewear designed to move with you.”

- CTA: “Shop Now” or “Discover Your Fit”

Step 1 →Define the CAC: LTV ratio. If your product has a healthy CAC: LTV ratio, proceed with paid ads.

Frame the Ad Budget

Budget Allocation:

- Total Monthly Budget: ₹10,00,000 (example allocation)

- Platform Allocation:

- Instagram & Facebook Ads: ₹7,00,000 (70%)

- Google Search & Display Network: ₹2,00,000 (20%)

- YouTube Ads: ₹1,00,000 (10%)

Ad Group Budget Breakdown:

- Ad Group 1 – “Everyday Fitness”: ₹3,00,000

- Ad Group 2 – “Size Inclusivity”: ₹3,00,000

- Ad Group 3 – “Comfort & Style”: ₹2,00,000

Bidding Strategy:

- Facebook & Instagram: Target Cost Bidding or Lowest Cost Bidding with daily budget caps to optimize for conversions.

- Google Display Network: CPC bidding focused on brand awareness.

- YouTube: CPV (Cost Per View) bidding to maximize reach and engagement.

Product Integration

I decided to go with Fitpass, Bollyx & flo

Channel Name | Time to Go Live | Tech Effort | New Users We Can Get (Monthly) | New Users We Can Get in Month 1 | New Users We Can Get in Month 2 | New Users We Can Get in Month 3 | Nature of integration | Reason |

Flo | Low | Low | Low | Low | Medium | Medium | Product Integration in Wellness Content | Flo’s focus on women’s health and wellness makes it a strong platform for Blissclub’s activewear. Users interested in maintaining a healthy lifestyle will find Blissclub products relevant. |

Nosie | High | High | High | Medium | High | High | Product Integration | Nosie’s focus on wellness makes it a high-impact platform for Blissclub’s wellness-oriented products. |

Headspace/Calm | Medium | Medium | Low | Low | Low | Medium | Product Integration | Partnering with a meditation-focused app can help Blissclub reach users seeking comfort and relaxation. |

Fittr | Medium | Medium | Medium | Medium | Medium | High | Channel Partnership | Fittr’s personalized coaching aligns well with targeted fitness apparel, offering high user engagement. |

StepSetGo | Low | Low | Medium | Medium | Medium | Medium | Activity-Based Rewards/ Product Integration | Users can be incentivized to achieve fitness milestones with Blissclub products, driving regular engagement. |

BollyX | Low | Low | Low | Low | Medium | Medium | Channel Partnership | Perfect match for dance-specific activewear, appealing to users interested in energetic dance workouts. |

Fitpass | Medium | Medium | Medium | Medium | Medium | High | Channel Partnership | Allows Blissclub to connect with a wide audience across various fitness activities, despite higher integration effort. |

HealthifyMe | High | High | Medium | Medium | Medium | High | Channel Partnership | A natural fit for health-conscious users looking for activewear that supports their fitness journey. |

Channel Integration with Fitpass would look like this

Referral Program/Partner Program

How to Earn Points:

- Referrals:

- Successful Referral: +100 points

- When a friend makes their first purchase using your referral code.

- Social Media Engagement:

- Tag & Share: +20 points

- Post a picture or video wearing Blissclub apparel on Instagram or Facebook, and tag @Blissclub.

- Partner App Engagement:

- Join a Fitness Session: +100 points

- Connect with one of Blissclub’s partner apps (e.g., yoga, Zumba) and participate in a session.

- Fitness Challenges:

- Weekly Challenge Completion: +50 points

- Complete the weekly fitness challenge (e.g., a 5k run, a yoga session) set by Blissclub.

1. Why Would Anyone Refer Blissclub?

- Brag-Worthy: Blissclub’s stylish, comfortable athleisure creates “Aha Moments” that customers love to share.

- Emotional Connection: Positive experiences and community vibe make users excited to refer.

2. Insights from User Calling

- Word of Mouth: A lot of users have bought our product from word of mouth

3. Rewards for Customers

- Referrers: Offer discounts exclusive merchandise & Free Community event passes.

- Referees: Provide first-time purchase discounts and early access to collections.

4. Referral Flow

- Seamless: Post-purchase over the display & order history tab.

5. Referral Message

- Crisp: “Refer Blissclub and unlock up to 50% off plus exclusive perks! Share the joy with your friends and elevate your fitness game together".

6. Tracking Rewards

- Visibility: A dashboard in the app/website to track points and rewards.

7. Increasing Referrals

- Incentives: Attractive rewards and group referral programs to boost multiple referrals.

Video for telling the user about the referral program

Watch this video to discover why Blissclub is the better choice over other brands.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.